AS SEEN IN

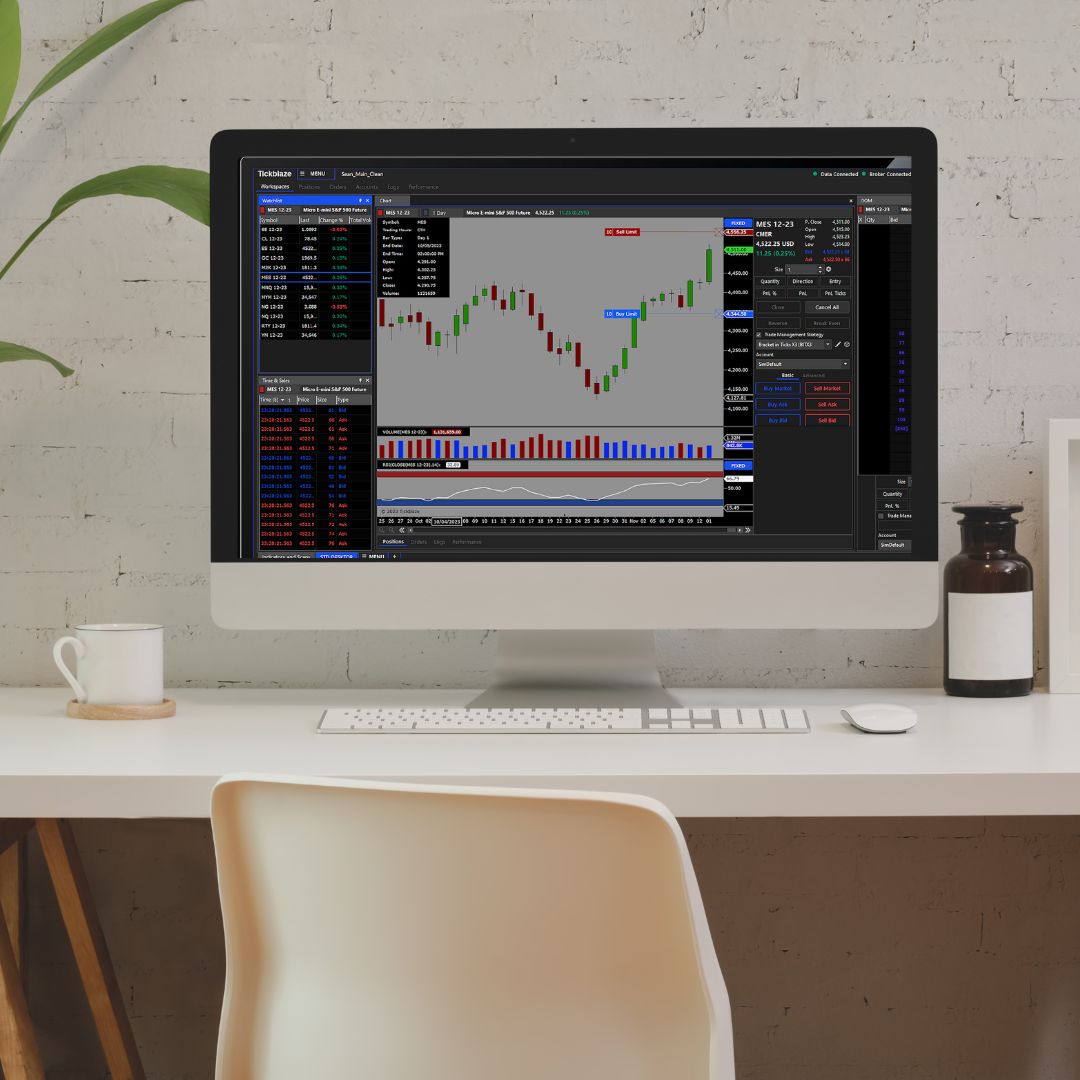

The Hybrid Trading Platform

Standard and Quant Desktops Available

Broker Neutral

Peer 2 Peer Community

Advanced Scripting C# and Python

Hybrid Platform

Live Trader Education

Retail Traders & Quants & Firms

Multi Asset

Vendor Network

Market Data Included

Broker Neutral

Hybrid Platform

Multi Asset

Peer 2 Peer Community

Live Trader Education

Vendor Network

Advanced Scripting C# and Python

Retail Traders & Quants & Firms

Market Data Included

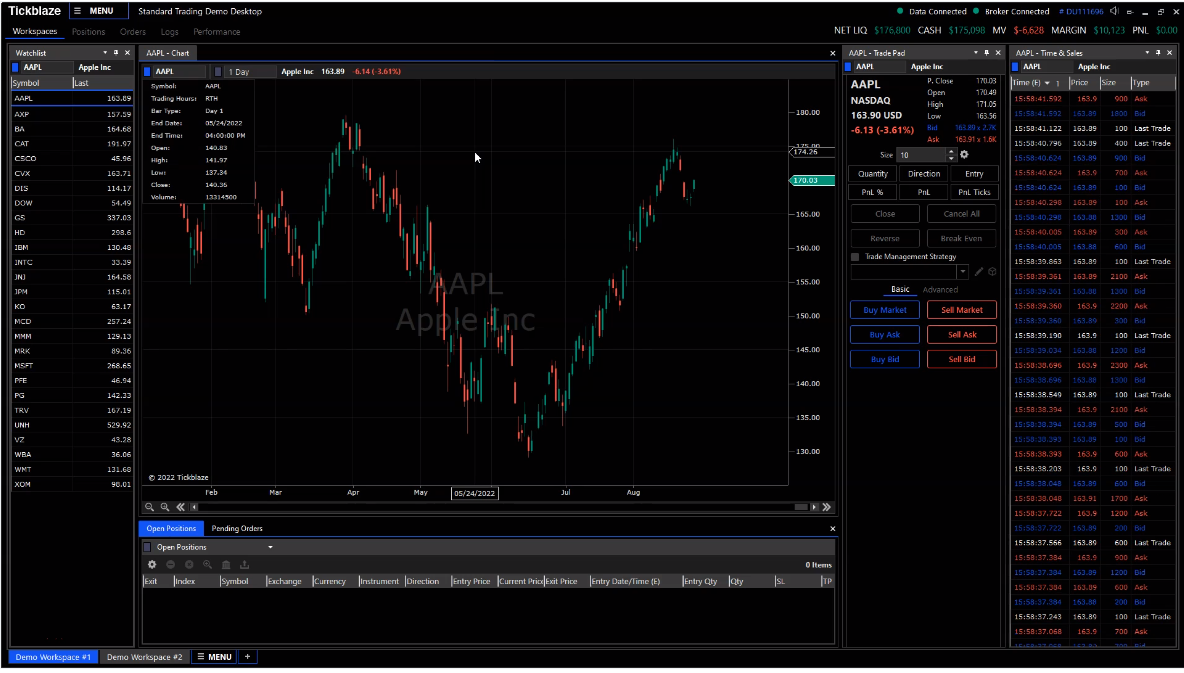

STANDARD DESKTOP

Discover a user-friendly trading experience with our Standard Desktop – the ultimate solution for discretionary traders. Boasting a custom user interface, intuitive order management, flexible chart trading, and custom trade management strategies, our platform simplifies the tech complexities of trading. Combined with unique charting tools, a robust indicator library, DOM trading, time and sales, watchlists, and scanning functionalities, we make trading easy, allowing you to focus on your strategies and success.

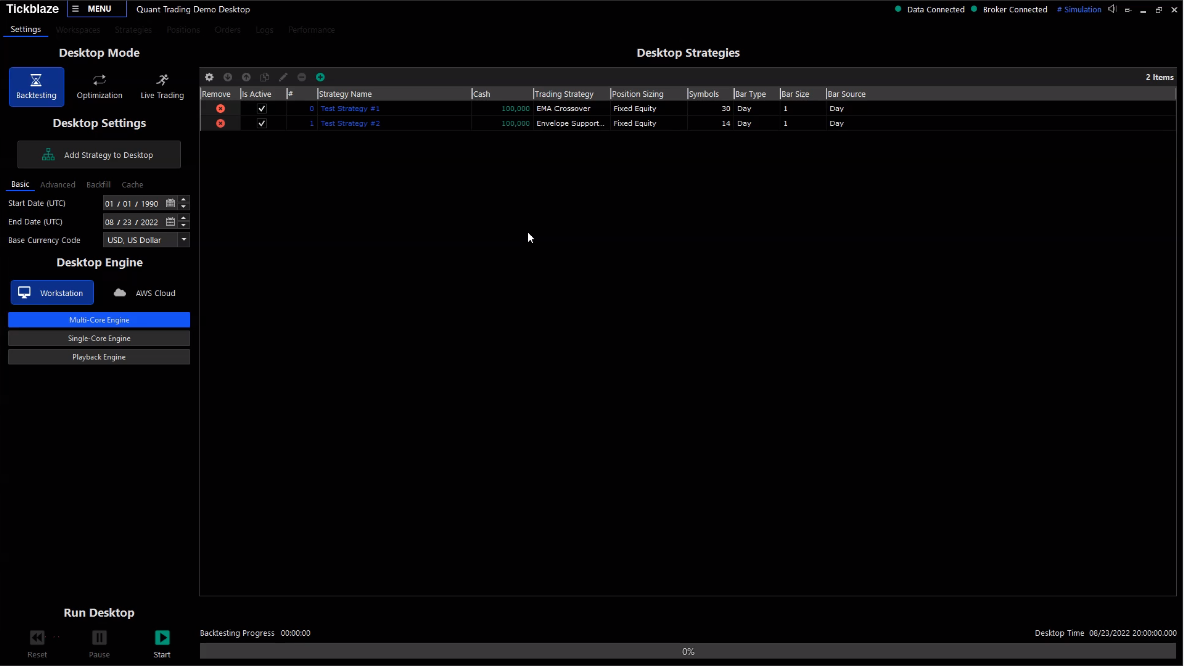

QUANT DESKTOP

Unleash the power of algorithmic trading with our Quant Desktop – the ultimate solution for quantitative traders. Engineered for precision, it excels in strategy development, backtesting, optimization, and execution. Harness the advanced strategy wizard for seamless design, monitor performance KPIs, and leverage portfolio quant capabilities. Whether you prefer desktop or cloud-based solutions, our platform empowers you with the tools to elevate your quantitative trading strategies to new heights.

Best Product, Best Value, Best Price!

Experience a paradigm shift in pricing with us – simplicity that matters. With just two packages, both inclusive of market data, we redefine

the norm. No more external purchases; just straightforward and cost-effective solutions that revolutionizes the way you trade.

Unsure about level 1 and level 2 market data? CLICK HERE.

Standard PRO

- Level 1 Market Data Included

- User-Friendly Dual UI

- Basic & Advanced Chart Trading

- Trade Management Strategies

- 200+ Indicators & Scripts

Hybrid PRO

- Level 1 Market Data Included

- Standard Package (Plus+)

- Strategy Development

- Backtesting & Optimization

- Portfolio Quant Solutions

Standard PRO

- Level 1 Market Data Included

- User-Friendly Dual UI

- Basic & Advanced Chart Trading

- Trade Management Strategies

- 200+ Indicators & Scripts

Hybrid PRO

- Level 1 Market Data Included

- Standard Package (Plus+)

- Strategy Development

- Backtesting & Optimization

- Portfolio Quant Solutions

Standard NON-PRO

- Level 2 Market Data Included

- User-Friendly Dual UI

- Basic & Advanced Chart Trading

- Trade Management Strategies

- 200+ Indicators & Scripts

Hybrid NON-PRO

- Level 2 Market Data Included

- Standard Package (Plus+)

- Strategy Development

- Backtesting & Optimization

- Portfolio Quant Solutions

Standard NON-PRO

- Level 1 Market Data Included

- User-Friendly Dual UI

- Basic & Advanced Chart Trading

- Trade Management Strategies

- 200+ Indicators & Scripts

Hybrid NON-PRO

- Level 1 Market Data Included

- Standard Package (Plus+)

- Strategy Development

- Backtesting & Optimization

- Portfolio Quant Solutions

Standard NON-PRO

- Level 2 Market Data Included

- User-Friendly Dual UI

- Basic & Advanced Chart Trading

- Trade Management Strategies

- 200+ Indicators & Scripts

Hybrid NON-PRO

- Level 2 Market Data Included

- Standard Package (Plus+)

- Strategy Development

- Backtesting & Optimization

- Portfolio Quant Solutions

Standard NON-PRO

- Level 1 Market Data Included

- User-Friendly Dual UI

- Basic & Advanced Chart Trading

- Trade Management Strategies

- 200+ Indicators & Scripts

Hybrid NON-PRO

- Level 1 Market Data Included

- Standard Package (Plus+)

- Strategy Development

- Backtesting & Optimization

- Portfolio Quant Solutions

Frequently Ask Questions

Do You Have Any Questions?

We invite you to explore our FAQ section and unlock a wealth of valuable information at your fingertips. Whether you're a first-time visitor or a long-time customer, our FAQ is designed to address your most common queries and provide quick solutions to your questions.

Tickblaze is a multi-asset trading platform. You can trade Stocks, Crypto, Futures & Forex. To view more details visit our connection guide here https://tickblaze.com/connections/

Yes, we offer a 14 day free trial with delayed market data included.

JOIN THE WAIT LIST to start your free trial!

NO!!

With Tickblaze, real-time market data comes included in your paid membership!!

Windows 10

Intel Core i5, 2-cores, 4-threads

8GB RAM

Microsoft .NET 8

DirectX10 compatible graphics card highly recommended

Articles & Tips